Insurance companies are facing an unprecedented dilemma in insuring motorists. It is now riskier than ever to satisfy insurance obligations because too many vehicles are being affected by extreme weather and being written off as totaled. The owners must then be compensated for the maximum value of what the vehicle would have fetched on the retail market had the damage never occurred.

Why Must Insurers Total Vehicles Affected by Extreme Weather?

Today’s modern vehicles are loaded with sophisticated electronics and designed to deform on impact. As a result, any deluge or encounter with the forces of nature can entirely destroy a vehicle’s value. Considering that a high-quality paint job can start at $7,000, just about any exposure to extreme winds can damage the paint and put the driver underwater on their car loan if the insurance doesn’t cover it.

It is difficult enough to repair minor fender-benders because of the exotic metals and specialized equipment now needed to restore the modern vehicle, a problem compounded by the sheer lack of qualified laborers. Adding in the common occurrence of electrical gremlins from water exposure or dozens of large hail stone dents all over the sheet metal, it is easy to imagine how quickly book value is depleted.

Why is Extreme Weather Increasing?

Extreme weather is believed to be a product of global warming attributed to the burning of fossil fuels. Although there are critics who believe that global warming is just a natural cycle of the earth’s weather patterns, it is hard to shrug off the heatwaves, hurricanes, tornadoes, hail, and flooding intensifying over the last few decades.

Although volcanism also has a similar impact on Earth’s atmosphere by the release of greenhouse gases, we have quickly moved from the Little Ice Age period at the time of the Washington crossing the Delaware River into a period of tropical climates consuming temperate zones. See examples here.

An extreme heatwave hit Europe in 2022, scorching residents with temperatures reaching 104–109 °F. These warm temperatures also influence the weather patterns because they affect the formation of tropical storms that develop into hurricanes from dust blowing off the African shores. See examples here.

Chaotic weather patterns affected by global warming may also make it feel unusually cold in the summer or warm in the winter. The clash between hot and cold air masses can collide and form severe storms. If you have ever been to Texas, you may have noticed how the clouds start converging together from all four directions before a tornado forms.

How Are Insurance Companies Resolving the Issue?

Insurance companies are brainstorming solutions to minimize their exposure to risk while still keeping insurance premiums affordable. The automotive industry is dependent on affordable insurance, since it’s one of the costs required when someone finances a new vehicle.

Automobile manufacturers are trying to find ways to make new cars easier to repair. But that won’t be easy with all the complex safety systems and gadgets that consumers desire. It costs over $1 billion to engineer a new model, which makes it difficult to serve a segmented population with weather-resistant needs. The conversion to electric vehicles will not help matters because water and electricity don’t mix, so even severe rains can cause permanent damage.

Another solution may be finding ways for insurance companies to form partnerships with a particular dealership. The dealerships can gather accurate data on specific models in a region to assess the true risk of insuring the vehicle with statistics to back it.

Right now, insurance companies rely on underwriters who finance their insurance premiums. If the insurance plans can be rated accurately, like bonds, then underwriters will have greater confidence when considering the actual risks of covering a particular driver. Charging higher premiums or deductibles for drivers who live in extreme-weather-prone areas, like Florida and Tornado Alley, can also offset the costs of coverage.

What Can Driver’s Do?

If drivers want to decrease their coverage costs, they can build stormproof garages to keep their vehicles. Hail damage is very common in some states, including Texas and Oklahoma. Being prepared with an appropriate shelter for your vehicle can reduce the need for claims.

Drivers can also vote with their wallets and evade the hassle and expense of filing a claim by demanding sturdier vehicles. They can purchase sturdier vehicles that will hold up to extreme weather, such as trucks with higher ground clearance fitted with snorkels to drive safely through flooded areas.

What Can Lawmakers Do?

Lawmakers can mandate that vehicles sold in a particular region are all outfitted with improved engineering to eliminate the damage associated with the types of extreme weather common there.

They can also build infrastructure for people to shelter in underground parking, for example, when a large tornado is passing through. These measures can save lives and property from extreme weather damage.

Conclusion

Insurance companies, indeed, need to put more of the onus of repairing damaged vehicles on consumers who live in extreme weather regions. Insurance companies can also incentivize drivers into buying sturdier vehicles with discounted coverage and publicizing the cost-savings.

Lawmakers can help to make these dreams a reality by mandating the change so that automakers are no longer concerned about losing a competitive edge in a particular market.

And consumers need to take reasonable steps to minimize their dependence on insurance. Relying on full coverage policies, instead of common sense, when severe weather hits may be a setup for failure.

Insurance agents may start writing in indemnification clauses that allow them to find contributory negligence when the drivers fail to protect their investment. Therefore, drivers should read their policies carefully to be sure their vehicle is actually covered by the extreme weather in their region.

When Purchasing a Vehicle

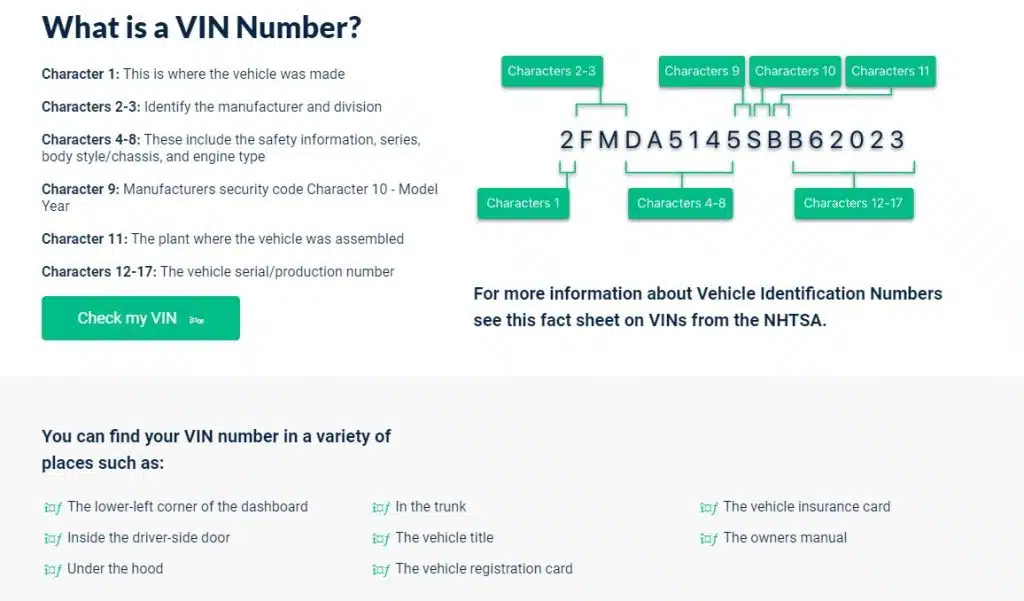

Always remember to run a VINsmart report on any used vehicle before making a purchase. A VINsmart report runs a complete history on the vehicle including whether it has ever been reported as stolen, involved in a major accident, or listed as a totaled vehicle.

VINsmart reports will also give you a registration history and mileage at registration. It reports any significant incidents related to the vehicle, such as being involved in a fire or flood.

When purchasing a used vehicle, the best way to ensure you make a good purchase is to know the vehicle’s complete history.