As a car owner, you likely understand the importance of having active auto insurance coverage. Besides keeping you protected in an accident, a good policy safeguards your investment.

Despite this need, no one looks forward to hefty payments for proper coverage. Most people across the country had to pay more to renew their policies over the past year or so. While auto insurance costs differ due to various factors, the rates are significantly higher this year.

Luckily, there are effective ways you can save on auto insurance. Let’s discuss some ways to help you save more without compromising coverage.

Why Am I Paying More for My Car Insurance?

As the CPI (Consumer Price Index) by the US Bureau of Labor Statistics outlines, car insurance costs went up last year. Drivers have to pay more for insurance, even as inflation continues to rise.

Several factors cause auto insurance costs to rise. Some experts believe that the recent losses insurance providers incurred motivated the steep increase. You may also be paying more due to other factors, such as:

Higher Used Car Prices

A car’s value plays a key role in the cost of insurance coverage. Used vehicles are more expensive because car parts now cost more to replace. The parts required for repairs and computer components are more expensive due to inflammation.

Climate Change

Climate change increases the frequency and severity of harsh weather and natural disasters. This affects auto insurance since companies are making more losses through larger payouts associated with catastrophic claims. The providers, in turn, increase the standard rates for home and auto insurance to cushion the blow.

How to Save on Auto Insurance

As auto insurance rates continue to rise, there are effective steps you can take to lower the amount you pay for your policy. Some examples include:

- Maintain a Clean Driver’s Record

Although some factors that affect auto insurance prices are beyond our control, careless driving is not. Getting speeding tickets or causing at-fault accidents can make the insurer raise your rates.

It’s best to observe speed limits and avoid all types of driving incidents and accidents. Being a safe driver protects you from expensive violation costs and keeps your insurance costs low.

Furthermore, you can claim extra discounts if your driving history is violation-free and claims-free.

- Compare Auto Insurance Quotes

When shopping for car insurance, ensure you compare quotes from different providers to find the best policy for your particular needs. There’s no harm in comparing several quotes every year if you have relied on the same provider for several years.

- Optimize Insurance Discounts

Another way to save on auto insurance is to maximize your discounts. Most insurance companies offer different discounts that you can combine to save more. You can qualify for auto insurance discounts such as:

Loyalty discount – You may qualify for a loyalty discount if you’ve maintained the same provider for a few years. You can also be eligible if you have had an active policy for an extended period.

Profession-based discounts – Being part of a particular profession can help you save on auto insurance. Most providers offer discounts for deployed military service members and other noble professions like nursing and teaching.

Low mileage discounts – If the number of miles you drive within one year falls under a certain bracket, like 10,000, for example, your insurer can offer you discounted rates.

Safety feature discount – You can easily earn another discount by installing additional safety features like anti-lock brakes.

Multiple policy discounts – Combining home and auto insurance from the same provider can help you save. Check with your provider to see which policies you can bundle for lower rates.

Work on Your Credit Score

If you’re wondering whether your credit score relates to your auto insurance, it turns out it does. During the underwriting process, insurance providers determine the policy rates using a credit-based insurance score (CBIS). Insurers will consider you less risky if you boost your credit score by:

– Paying off your credit cards and loans on time

– Handling credit cards responsibly by keeping the balances below the credit limits

– Getting new credit cards on a need basis, as having too many cards affects your score

- Raise Your Deductible

Auto insurance coverage has a deductible. The deductible is what you pay out of pocket in case of an incident before your coverage becomes active. When purchasing your policy, you can choose how much you wish to pay, with common options being $500 and $1000.

A quick way to save more on comprehensive and collision insurance is to increase the deductible. The amount to save varies by provider, so ensure you compare different deductible levels from different companies.

Remember to set some money aside to cover the deductible in case you get involved in an accident.

- Opt For an Insurance-friendly Car

Your vehicle of choice affects how much you will pay for auto insurance. Some vehicles, like fast or sporty cars, are more expensive to insure than those that prioritize safety, like minivans.

However, more affordable vehicles are not always cheaper to insure. If you anticipate expensive repairs, your insurance rates will likely be higher.

Generally, vehicles with lower auto insurance rates are such as:

– Honda CR-V

– Subaru Outback

– Ford Escape

– Jeep wrangler

– Subaru Forester

- Switch to Usage-based Insurance

Pay-per-mile or usage-based insurance is ideal if you’re comfortable with driving behavior tracking. This coverage involves a per-mile rate and a base rate, which is perfect if you don’t drive long distances. The safer a driver you are, the lower the rates.

Most insurance providers require you to install a device or download an app that helps monitor aspects like your speed, driving habits, and mileage. The app or device then sends the data to your provider.

Why Pay More on Auto Insurance?

Having a robust auto insurance policy is vital to protecting you and your vehicle in the event of an accident. But you don’t have to pay more than you need to for the same coverage.

Whether you choose a comprehensive policy or a liability-only policy, you can use these tips to save more and get more financial breathing room.

When Purchasing a Vehicle

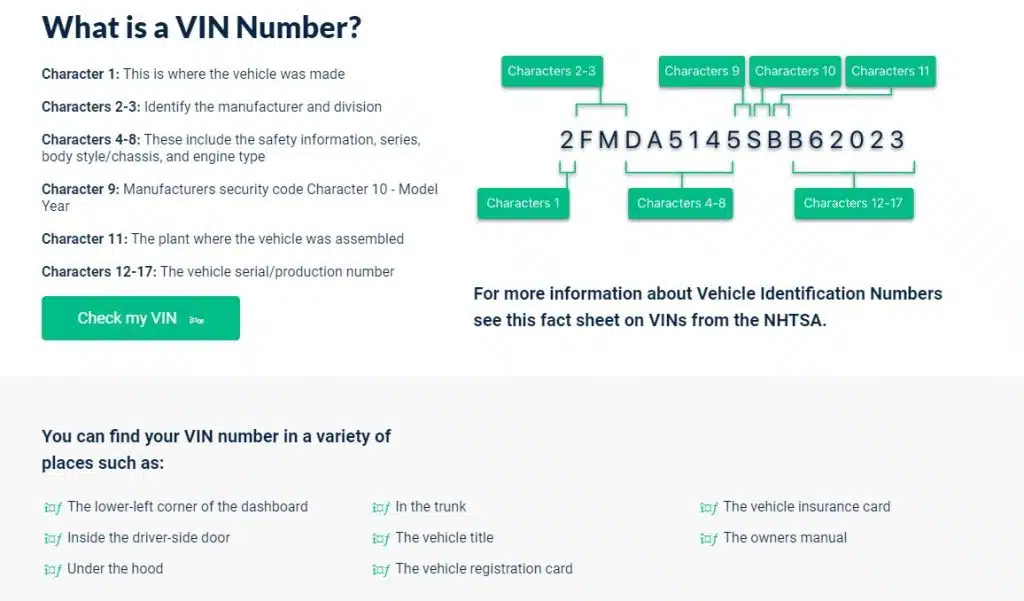

Always remember to run a VINsmart report on any used vehicle before making a purchase. A VINsmart report runs a complete history on the vehicle including whether it has ever been reported as stolen, involved in a major accident, or listed as a totaled vehicle.

VINsmart reports will also give you a registration history and mileage at registration. It reports any significant incidents related to the vehicle, such as being involved in a fire or flood.

When purchasing a used vehicle, the best way to ensure you make a good purchase is to know the vehicle’s complete history.