Car crashes can be terrifying events that have long-term effects on one’s finances and emotional state. The state of your car is frequently one of the main worries following an accident. There’s a point at which the damage is so bad your car is considered totaled. It’s critical to understand what constitutes a totaled car and the indicators that point to this irreversible condition.

When an insurance company declares a vehicle to be totaled, it indicates that the cost of repairs has surpassed a predetermined portion of the vehicle’s Actual Cash Value (ACV). This percentage usually falls between 70% and 100% of the ACV, though it varies depending on the state and insurance company. The insurance provider has the right to declare the vehicle totaled if the repair costs exceed this limit.

Indications That Your Car May Be Totaled

Knowing when your automobile is totaled can help you navigate the claims process and make informed decisions regarding your vehicle’s future. Let’s explore the signs that your vehicle may be headed toward a total loss in more detail:

1. Damage Extent

Visible Damage: Examine the visible damage to your car. If there is significant damage to the car, including the front, back, and sides, the cost of repairs might rise quickly and beyond the maximum amount your insurance provider would pay.

The degree of Structural Damage: It’s a bad sign if the chassis, frame, or other structural parts have significant damage. Destruction of the structure jeopardizes the vehicle’s integrity and safety, increasing the likelihood that it will be declared irreparable.

2. Deployment of Airbags

A substantial collision initiates the airbag to deploy. While airbag deployment is not always the result of a totaled vehicle, it is a reliable indicator of the force of the impact. If the airbags have deployed, there may have been significant damage to the car from the collision.

3. Frame Damage

A crucial factor to consider is frame damage. The vehicle’s structural integrity is provided by the frame, and any damage to it could make the vehicle unsafe to drive. When determining if a vehicle is totaled, insurance companies frequently take frame damage into consideration.

4. Mileage and Age

Vehicles with more mileage or those that are older may be more likely to be totaled. Even if the visual damage appears repairable, the insurance company may take the car’s age and mileage into account and may determine that the cost of repairs will exceed the car’s total market value.

5. Professional Estimate

Professional mechanics and insurance adjusters are essential in estimating repair costs. Their knowledge enables them to evaluate any hidden problems that might occur during repairs in addition to any obvious damage. It increases the chance that the car will be totaled if their estimate is close to or more than the car’s worth.

6. Uninsured Losses

Even seemingly insignificant damages could result in a total loss if your car is uninsured or does not have comprehensive insurance coverage. The car is more likely to be totaled if the repairs become unnecessarily expensive without the funding that is required.

7. Laws and Guidelines

There are differences in state laws about what constitutes a totaled car. The limits on repair expenses as a percentage of the car’s value are more stringent in some states compared to others. It’s important to be aware of state-specific rules because they may affect the insurance company’s choice.

8. Invisible Damage

Consider the possibility of concealed damage to important mechanical and electrical components in addition to obvious damage. The decision to total the car may be influenced by the rising repair costs if the collision damages vital components like the engine, transmission, or electrical wiring.

9. Pre-Accident Value

The projected cost of repairs will be compared to the car’s value. The insurance company may decide to declare the vehicle totaled if the cost of repairs approaches or surpasses the Actual Cash Value (ACV).

10. Multiple Claims

The decision to total your car may be influenced by the cumulative effect of previous accidents on its value. For the insurance, repairs may become less economical if the same vehicle is the subject of multiple claims.

11. Fluid Leaks

After an accident, leaking fluids—particularly oil, coolant, or transmission fluid—indicate serious damage. Significant leakage from crucial components like the engine can increase repair costs and perhaps cause the car to be totaled. Leaks that occur widely could be dangerous, lowering the car’s value and safety and impacting the decision of the insurance company. The presence of leaks implies potential damage and safety risks, which are important considerations when determining whether the car can be repaired.

The Aftermath of a Totaled Vehicle

When an automobile is declared totaled, the insurance company usually takes ownership of it and pays out the actual cash value, less any deductible. If the owners decide to fix the totaled car themselves or utilize it for spare parts, they may be able to repurchase it at its salvage value.

If your car is involved in an accident take the following steps:

1. Record the Damage: After an accident, take pictures and record every relevant detail. Your insurance claim may be supported by this documentation.

2. Consult Your Insurance Provider: Get in contact with your insurance company right away. They will advise you of the next steps and walk you through the claims procedure.

3. Know Your Rights: Educate yourself on your insurance coverage and the state’s regulations pertaining to totaled cars. You can easily navigate the process with the help of this knowledge.

4. Explore Alternatives: Talk to your insurance provider about your alternatives if your automobile is totaled but has sentimental value or you think it can be fixed. It may be possible for you to repurchase the vehicle for salvage.

Conclusion

The degree of damage, the cost of repairs, and state laws all play a role in determining whether a vehicle is totaled. Even though facing a totaled car is distressing, knowing the warning signs and the steps to take might lessen the financial and psychological strain that comes with it. When handling a totaled car, you should always put safety first and adhere to the steps your insurance provider and local laws specify.

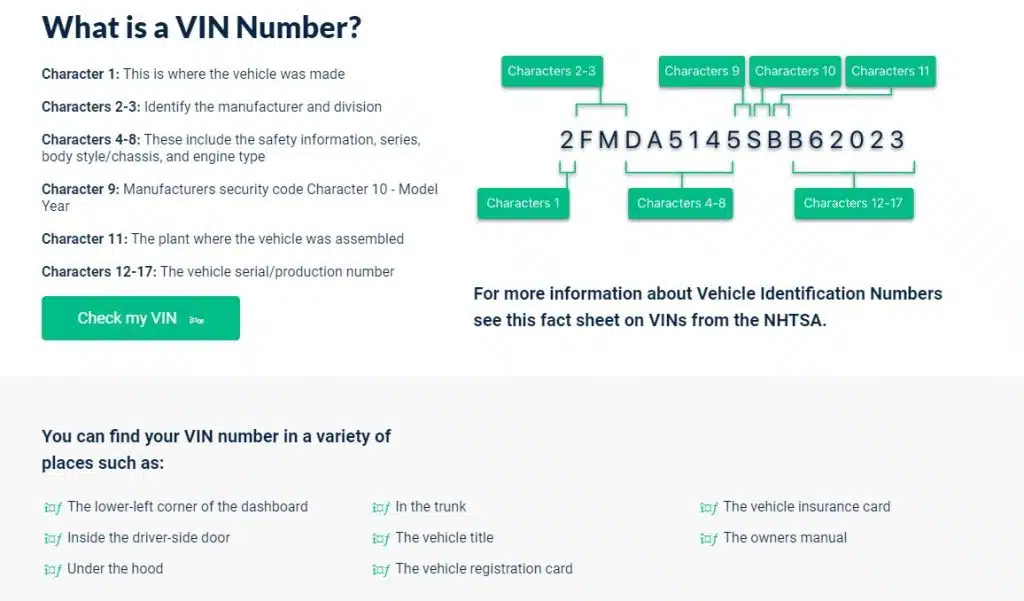

When Purchasing a Vehicle

Always remember to run a VINsmart report on any used vehicle before making a purchase. A VINsmart report runs a complete history on the vehicle including whether it has ever been reported as stolen, involved in a major accident, or listed as a totaled vehicle.

VINsmart reports will also give you a registration history and mileage at registration. It reports any significant incidents related to the vehicle, such as being involved in a fire or flood.

When purchasing a used vehicle, the best way to ensure you make a good purchase is to know the vehicle’s complete history.