What is a Good Interest Rate for a Car Loan?

When it is time to buy your next vehicle, the one thing that can make or break the deal is the car loan. Most people do not have the cash to purchase a vehicle outright, so they rely on financing.

A high-interest rate may make the vehicle unaffordable or extend the payments longer than you feel comfortable. Finding the best rate will help you get the car you want at an acceptable price.

Interest rates on a car loan are affected by three things:

* Car lot you purchase your vehicle from

* If it is a new or used vehicle

* Credit score

If you are careful about each of these items, you can secure the best deal for a car loan.

Verify The Details

The first thing you want to do is shop for a vehicle at a reputable car lot. Larger lots will have good standings with finance companies, and this can make a large difference in being able to secure good financing.

Many smaller lots work with fewer finance companies or smaller finance companies, which can limit your financing options. Some of these lots may also be considered a risk with the finance company, leading to higher rates. Finance companies view lots with a high return or repossession rate as high-risk and will increase finance charges for all buyers.

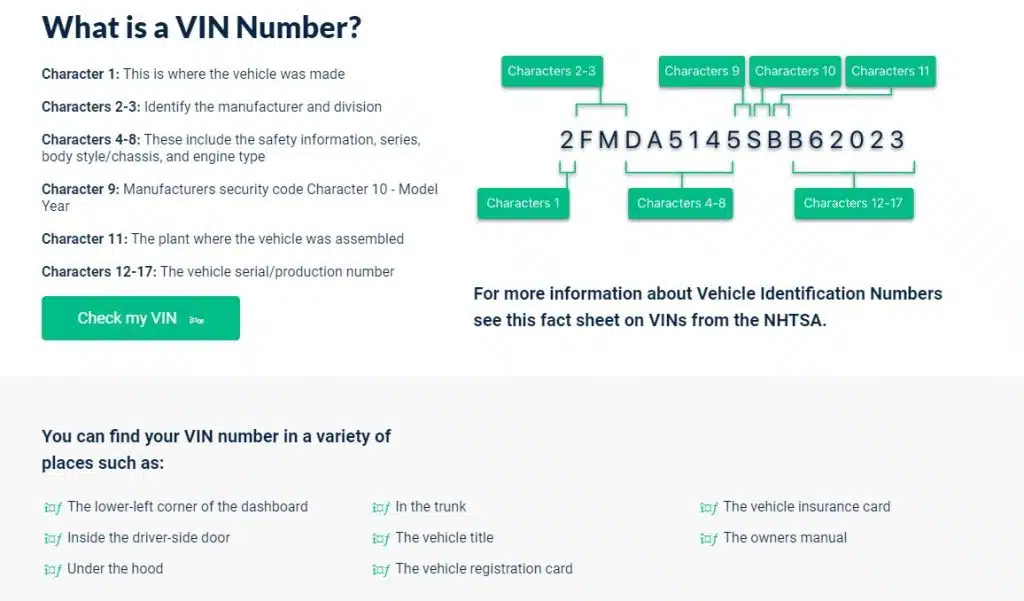

If you are purchasing a used vehicle, you will also want to get a VIN history report of the vehicle. The VIN report will tell you if the car has ever been in an accident, reported stolen, or classified as totaled. All of these things can have an impact on financing.

Also, checking a vehicle’s VIN history report can help you save on your car insurance. If your car has had previous damage or is classified as a totaled vehicle, you may pay much higher insurance premiums or not be able to get insurance at all.

Your Car Loan Interest And Credit Score

Your credit score will have the most impact on your car loan. Loans are classified into five ratings that range from super prime to deep subprime. The interest rates you pay will be based on your loan ranking.

In most cases, the following interest rates apply to each loan level:

* Super Prime loans average 2-4% interest rates

* Prime loans average 3-6% interest rates

* Nonprime loans average between 6-11% interest rates

* Subprime loans average 11-18% interest rates

* Deep subprime loans can have as high as 14-21% interest rates

Your long type will be based on your credit score. Of course, the higher your credit score, the better loan you will qualify for when purchasing a vehicle.

Shopping around for a loan can help you reduce your interest rates, even with bad credit. However, when you reach the subprime and deep subprime categories, you will pay much higher rates regardless of the lender.

You do not have to use the loan offered by the car lot. You can check with your bank or credit union first to see their loan rates. Some credit card companies are also offering car financing for established customers.

If you take a higher rate on your car loan, you can refinance it at a later time. This may or may not make a difference in the interest rate you pay, but it may reduce your monthly payment.

Check Your Credit Score Before Car Shopping

Checking your credit before you purchase a vehicle may be your best option for getting a great interest rate on your car loan. Checking your credit reports for errors and seeing your score will benefit you in every area of your finances.

You can obtain a free credit report from each credit bureau once a year. You can do this online or by calling their toll-free number. If you do it online, you can instantly download and open your credit report from each bureau.

Check your reports for accurate information. You will want to review everything from the spelling of your name to each account listed on the report. This ensures that you catch any mistakes.

The government has released data showing that nearly 75 percent of credit reports have one or more mistakes that can impact their credit score. This is why it is so important to review the information.

If you find any problems, file a request to review or remove the item. You can do this online, so there is no delay in the process. Once you fix these problems, usually within 30 days, you will see your score improve.

It is also recommended that you do not apply for any other lines of credit for at least 60 days before you apply for a car loan. Having too many credit inquiries on your report can have a negative impact on your score. This is one of the easiest ways to improve your credit score before buying a car.

When Purchasing a Vehicle

Always remember to run a VINsmart report on any used vehicle before making a purchase. A VINsmart report runs a complete history on the vehicle including whether it has ever been reported as stolen, involved in a major accident, or listed as a totaled vehicle.

VINsmart reports will also give you a registration history and mileage at registration. It reports any significant incidents related to the vehicle, such as being involved in a fire or flood.

When purchasing a used vehicle, the best way to ensure you make a good purchase is to know the vehicle’s complete history.