Finding the best financing is part of getting the best price when purchasing a vehicle. Everyone knows that you can negotiate the price of the car, but not many people realize you also have choices regarding financing. To get the best financing for your purchase, use the following guideline.

Be Aware of Your Credit Score Before Going to Dealership

The first thing that you want to do before shopping for a vehicle is to check your credit score. Your credit score will be used to set the interest rate for your auto loan. Higher scores will get better interest rates.

Review your credit reports and clear up any issues you may find to get the best possible score before applying for financing.

Decide Where You Want To Acquire Financing Before Car Shopping

You should inquire about financing from somewhere other than the dealership first. You can check several places for the best car loan deal.

Some of the places you may wish to check for financing include:

- Personal bank or credit union

- Some credit card companies offer car financing to credit car customers

- Use a loan comparison site

- Online auto loan marketplaces

Make sure that when you use comparison sites, they are going to give you real loan information. Some of these sites are lead generators for lending companies, and the information they provide may not be accurate or enough for pre-approval.

You will also want to ensure that any pre-approval you receive pulls a soft credit check. Soft credit checks will not impact your credit score. Seeking too many credit approvals on your credit report (e.g. hard checks) can lower your score, which can lead to higher interest rates.

By shopping around for loans before you go to the dealership, you will know what to expect for an interest rate, which will help you determine if dealership financing is better. Take any preapproval letters with you to the dealership.

Be Ready For Your Trip to the Dealership

You must be ready for the financing push when you get to the dealership. It is essential to know that this is where many dealerships make the most money by offering to finance the vehicles.

Dealerships often receive a portion of the loan when they finance the vehicle as payment. Some finance companies will give dealerships a percentage of the interest; others provide a standard payment for using their finance company. Because there is profit to be made here, the dealers will always push to use their own financing.

Some dealers will also use financing to push their insurance and warranty products. These insurance products and extended warranties are expensive and almost always 100 percent profit for the dealership. The dealer will offer you a lower interest rate if you add on one or more of these products as a selling tactic.

Refrain from falling for this trick. A lower interest rate on a larger debt may cost you more in the long run. These warranties and insurance products are very expensive from the dealer. If you need these products, check an outside source after leaving the dealership. Most of these products are available from insurance companies for a fraction of the price when purchased directly.

Yes – You Can Negotiate Like a Cash Buyer

The most important thing for you to remember is that you are the customer. You are the one who is going to have to make that loan payment each month, and you have the final say on what you are going to pay and to whom.

Car dealerships are experienced in making the financing process chaotic, so they can benefit most from the transaction. Stick to your plans, regardless of their pressure. If you have preapproval letters in your hand, feel free to get up and leave the dealership to purchase from another dealer. They will act more friendly when they know you are willing to leave to get the best deal.

When you arrive prepared, you are in a position to get the best deal on a new or used vehicle. Having your financing options available before you go to the dealership will give you the knowledge you need to arrange for the best deal. Knowing what vehicle you want and the average price for that vehicle will also help you negotiate a great price.

Shopping for a vehicle has become much easier because so much information is now readily available. In the past, you had to rely on the dealership to provide you with the best vehicle deal and financing. Now, you can be an informed consumer and arrive at the dealership knowing what you are willing to pay for the car you desire.

When Purchasing a Vehicle

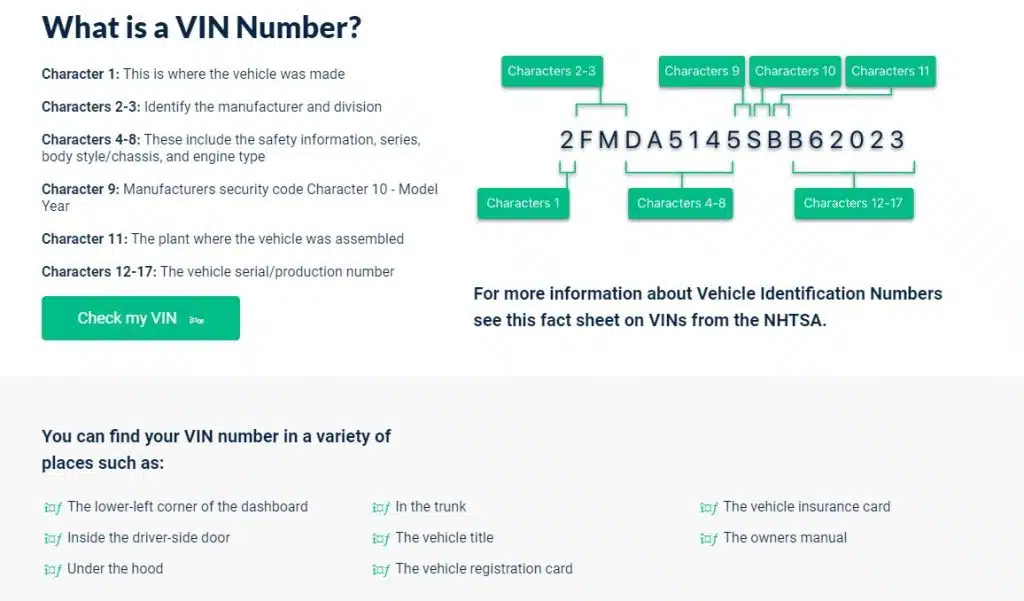

Always remember to run a VINsmart report on any used vehicle before making a purchase. A VINsmart report runs a complete history on the vehicle including whether it has ever been reported as stolen, involved in a major accident, or listed as a totaled vehicle.

VINsmart reports will also give you a registration history and mileage at registration. It reports any significant incidents related to the vehicle, such as being involved in a fire or flood.

When purchasing a used vehicle, the best way to ensure you make a good purchase is to know the vehicle’s complete history.